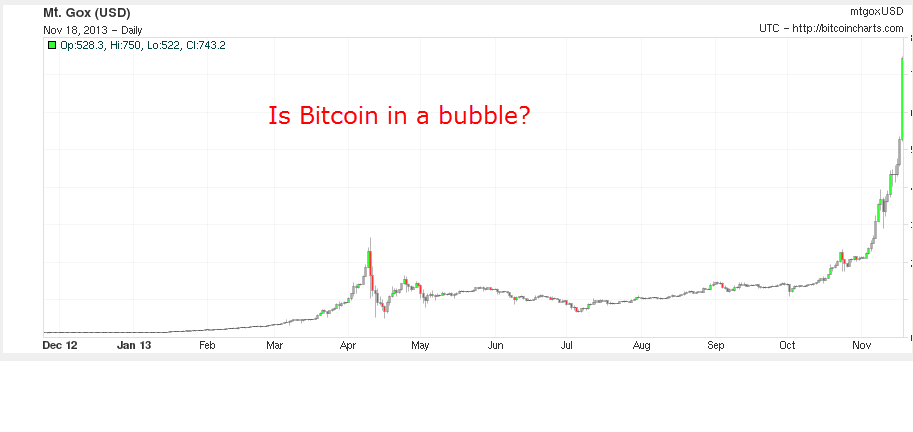

Bitcoins – the talk of the town currently – have rocketed from $12 a year ago to a recent high of $1200. Now that’s what I call a bull market! Many are calling it a bubble, and who is to disagree? A Bitbubble perhaps? Stories

Tag: Elliott Waves

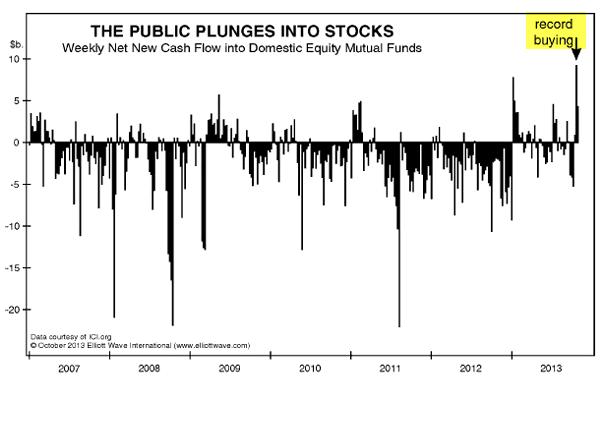

There is a great deal of uninformed rubbish written about the behaviour of US retail stock investors in the media (including seekingalpha.com). Many are saying there is a wall of money in money market funds that is just itching to get into the stock

“To taper or not to taper, that is the question” (thanks, William). But do you know what – this question is almost redundant. And do you know why? It is because everyone is talking about what the Fed will do. And when all eyes

The non-farms are in for November and the unemployment rate is down to 7% from 7.2%. Now everyone is proclaiming the end to QE – and the Fed will start tapering this month for sure. That’s the line being handed out. If this is

At major market tops, there is an explosion of opinions from pundits as to why stocks will keep going up. It is one of my favourite indoor sports reading such drivel, although I try to limit it as my doctor has advised me my

The odds are stacking up now that I have found the top in US stocks, as per my Weekly Wrap analysis (and my MW Trader coverage of the FTSE). The S&P reached a Fib target on Friday (w5 = 0.618 x w1-3) and

When I started trading, I did what virtually everyone else did in a roaring bull market. I became even more bullish! Wow! If the market can get to 16,000 from 6,500 in only less than five years, who knows where it will be in

The ‘surprise’ deal with Iran over its nuclear programme gave the markets a boost yesterday. This was no surprise reaction. But is that it? Was that the final run on the upside, and have stock markets now become exhausted of buying power? The Iran

Another week, another weekly stock market gain. Ho hum. Just about everybody is on board with Investors Intelligence (professional advisors) sentiment reading at a bullish extreme where previous tops were made (at least since the 1987 crash). The VIX is approaching 12 which is

Big falls in all markets yesterday as they acted in concert – and confirmed my view that in a deflationary world, all assets decline in price. In fact, Prechter calls this phenomenon “All the same market”. Gold is currently the biggest loser of all,

Here is just one more reason to believe the stock rally is coming ot an end – stock buy-backs. This is a little-reported theme, but is one that is worthy of note. US companies have been buying their own stock in an effort to

On Wednesday, my post was “Nasdaq leads the charge” – and I was referring to the five-year old rally. I had a firm tramline target in place and the market was heading for that level. While I was away at the London Money Show,