Like most people, I follow the incredible story of UK house prices and their stratospheric ascent in recent years. As I have pointed out before, the chart since WWII shows a lovely five wave pattern Isn’t that pretty? We are in the final fifth wave

Tag: silver

Regular readers will know I have been not so patiently waiting for this. It is a common observation that currency markets often extend trends far longer than you think possible. In Elliott wave terms, we see many extended fifth waves and these are often the

I continue to be amazed at the lack of understanding out there on how markets really work – and this is among professional money managers who should know better. I wrote to my VIP Traders Club members this morning with this quote from AEP in

Ever since the big crash of 2007 – 2009, I have been forecasting a deflationary depression for the global economy. I realise this is a very bold call. Some would even say it is totally nuts given today’s ‘Goldilocks’ economy.. What could possibly go wrong?

Who remembers the 1980s British TV series Tales of the Unexpected? They were stories with an unexpected twist at the end – and the stock market story of 2017 could well have been one of them! This Year of the Unexpected finished with shares coming

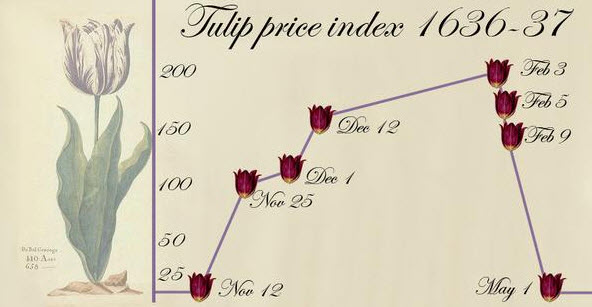

Remember the 1990s? When any company with a newly-invented basic website was bid up up and away even though it has no earnings nor any prospect of any? Even stolid old Auntie BT (with earnings) was swept up in the mania. Now we see that

Over the years, I have noted that ‘surprise’ price thrusts often occur on Fridays. During the week, the market is relatively quiet which lulls traders into a state of lethargy. And on Friday many professional traders are glad to escape the boredom and leave their

ANNOUNCEMENT I am now offering a 14-day Free Trial to my VIP Traders Club throughout the year. Sample a membership for free and see for yourself if it fits in with your trading style and profit goals. Details here. Yet another North Korean missile

When stocks make major highs, they do not all do it lockstep. And I believe a major high is upon us. But isn’t it curious that sentiment between the professional money managers and the public appears to be poles apart? Not when you accept that

Last time, I headed my post “Gold bugs squashed“, but the silver bulls have suffered even an greater percentage calamity. As I outlined, we have been short both gold and silver since identifying the high in mid-April and have been fortunate to ride the waves

Did anyone see that coming? What a collapse in gold and silver! From a high of $1295 on 17 April – a mere two weeks ago – gold is down almost $80. From a high of $18.65 on 17 April, silver is down $2.35. I

Great bull markets rarely give up the ghost easily. Just as St George found, his dragon took some time to roll over after the first stab. The vast majority of market tops are rolling affairs with the first decline being met by the army of Dip